KOKO’s Innovative E-Commerce Platform Engages Neighbourhood Shopkeepers in a New Model for Retail

- Ed Agnew

- Jun 5, 2017

- 5 min read

For years, the “Africa Rising” narrative was predicated on the emergence of a middle class across the continent. However, as mobile network operators have recognised to their benefit, the larger and more immediate market opportunity in Africa is the mass consumer segment. KOKO Networks – a technology venture based in Nairobi – is reinventing e-commerce with a focus on the $500 billion urban African mass-market.

Nothing says “emerging middle class” more than large shopping malls springing up across Africa’s major cities. However, for most mass-market families who earn income and spend informally, these much-hyped malls serve only as weekend tourism destinations. The bulk of retail sales continue to take place in small neighbourhoods shops close to consumers’ homes.

The World Bank estimates that the majority of Kenyan GDP is in the informal economy, and that 80 to 90 percent of Kenyan jobs are in the informal sector. For most consumers, the notion of a secure job with a monthly salary remains an aspiration. The daily reality is high income uncertainty and low purchasing power.

The mobile telecoms industry recognized this reality and enjoyed breakthrough growth in Africa after pivoting away from “post-paid” billing to the sale of small “pre-paid” bundles that suit the uncertainty of mass-market consumer incomes and informal retail structures. The unsung heroes of the African mobile industry have been the army of entrepreneurs who re-sell airtime and maintain cash floats in order to earn commissions on airtime and mobile money flows to mass market consumers.

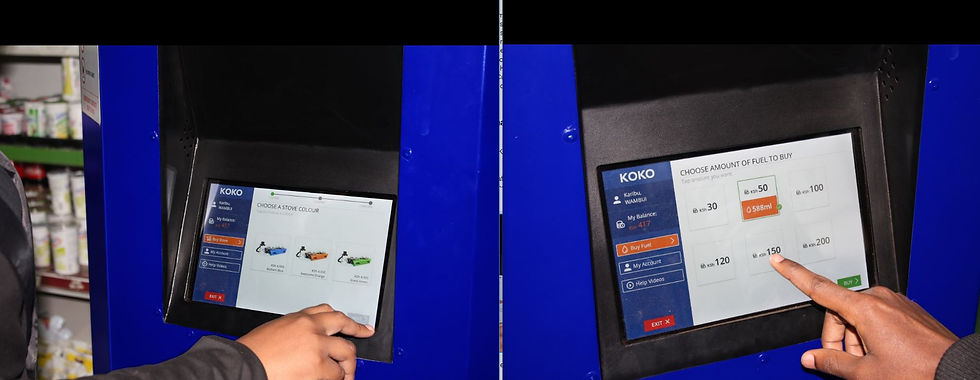

Similar insights helped shape KOKO Networks, a new commerce platform for urban Africa that launched earlier this year in Nairobi. Rather than replicate e-commerce business models from the West that bypass existing retailers, KOKO partners with neighbourhood shopkeepers, installing physical e-commerce access points – called KOKOpoints – inside their premises. These KOKO “agents” immediately increase the product selection and footfall at their shops, while local consumers get access to a unique range of products via interactive screens on the cloud-connected KOKOpoints. Orders are aggregated and delivered directly to the KOKO Agent shops, and consumers notified electronically when their order is ready for collection. Customers can also use KOKO’s smartphone application to track their orders and earn KOKO credit for making referrals among their social networks.

Product 1: Innovating to win in the $25 billion cooking fuels market

The first product offering on KOKO’s neighbourhood e-commerce platform specifically targets the urban market for household cooking fuel. Across Africa’s major cities, KOKO estimates that more than $25 billion is spent on cooking fuel annually.

The majority of this spend goes towards charcoal and kerosene, which are available in small purchase quantities and close to consumers’ homes. While mass-market consumers have long demanded a clean, safe and affordable alternative to these traditional cooking fuels, the need to offer small purchase quantities close to consumers’ homes has been a significant barrier for solutions like LPG (cooking gas) from reaching more than the wealthiest households in African cities.

KOKO addresses this market gap with “SmartCook” – a modern 2-burner cooking solution that runs on liquid ethanol-based fuel. Customers learn about and order SmartCook from their local KOKOpoints. A package containing the 2-burner stove and a refillable fuel canister is ready for collection from the same location within 24 hours. Each KOKOpoint has a proprietary dock into which the fuel Canister fits. The KOKOpoint then serves as a fuel “ATM”, safely dispensing liquid cooking fuel in volumes as low as $0.30 at a time directly into the specialised SmartCook canister.

The fuel is sourced from regional ethanol plants (which use sugarcane molasses, a waste product of the African sugar industry, as their feedstock) and then transported to urban petrol stations. Small tanker trucks carry the fuel the last mile from each petrol station to a network of surrounding KOKOpoints.

The entire supply chain is managed by smart hardware and software technology. KOKO’s IoT sensor network monitors cooking fuel inventory levels in every petrol station, tanker truck and KOKOpoint throughout the city. KOKO’s cloud software seamlessly forecasts demand across the network, places orders, tracks deliveries and settles payments between fuel suppliers and the neighbourhood shops as need to keep operations running smoothly. This level of integration means that KOKO doesn’t even need to own the fuel flowing via its network.

Greg Murray, CEO of KOKO Networks, explains, “We don’t want to be a fuels trader. Billions of dollars of existing infrastructure in Africa efficiently moves bulk liquid fuels through to petrol stations. These are the ‘arteries’, and our technology platform is the last-mile ‘veins’. KOKO’s platform connects fuels traders with mass-market customers via existing neighbourhood retailers, but we don’t need to trade the fuel or operate the fuels infrastructure ourselves.”

Murray and his business partners boast strong credentials in the nascent ethanol cooking fuel industry, having founded a major “proof of concept” venture in Mozambique that first commercialized ethanol cooking fuel in 2013. That venture successfully converted 10 percent of Maputo households from cooking with charcoal to ethanol within a year of retail launch, despite delivering no monthly fuel cost savings to consumers. Ethanol cooking fuel businesses have since sprung up around the continent that replicate this low-tech approach, but KOKO focused on innovation rather than merely scaling up the Maputo model.

KOKO’s new technology dramatically reduces the costs of marketing and distributing to the urban mass-market. As a result, SmartCook fuel is now available in Nairobi at a price point that significantly undercuts the cost of deforestation-based charcoal.

Product 2: Changing the game in mass-market advertising

While KOKO’s initial focus is on bringing SmartCook to the mass-market, the company has also launched a highly synergistic advertising business on its platform. McKinsey’s Africa Consumer Insights Centre reports that African mass-market consumers are highly receptive to advertising displayed at the point of purchase – that is, inside the small shops that serve as the main channel for moving consumer goods in African cities.

KOKOpoints are programmed to play targeted video advertisements to SmartCook customers while fuel is being dispensed into their canisters, and to play general “broadcast-style” ads while the KOKO machines are idle. Incentivised surveys allow KOKO to quickly map customers’ branded share of wallet. In competitive product categories such as vegetable oils, this means that brands can deliver video ads targeted exclusively at customers of rival brands, using a medium does not cost the consumer any smartphone “airtime” or “data”.

Partnerships: Developing Products and Scaling the KOKO EPlatform

Beyond SmartCook and the Advertising offering, KOKO is also developing solutions within the content, connectivity, financial services and retail sectors. The company’s approach is to conduct extensive research and development with target consumers, and develop innovative products in partnership with existing players in those sectors. Ultimately, KOKO provides the technology platform to connect suppliers, retailers and customers, continually innovating to better serve those customers and partners.

KOKO’s vision has been strongly backed by a wide range of international investors who recognise the opportunity in the urban mass-market. Rob Hersov, Chairman of African Capital Investments, explains that “KOKO is that rare breed of company that combines deep market insight with world-class technology and strong execution. We are proud to play our part in helping the company grow.”

Whilst KOKO is rolling out its network in Nairobi on its own, KOKO seeks to partner with strong, well-established operating businesses to accelerate network launches in other markets. The company’s expansion plans involve dozens of African cities, and licensing and joint venture discussions are already underway in East Africa.

KOKO’s scalability and ambition holds strong appeal to local partners and investors. Rob Eloff, Managing Partner of Lateral Capital, highlights that “the platform’s scalability across Africa was what initially attracted our interest. KOKO’s partnership strategy – across both industries and geographies – enables a triple-win for major local incumbents, for the neighbourhood retail sector and, of course, for mass-market customers.”

Ed Agnew

Comments